Sub-accounts: Flexibility for you

One of the most unique features of Manulife One is its flexible sub-account options.

Tracking sub-accounts

Tracking sub-accounts allow you to track part of your debt, and the interest it’s charged, separately, at the same low variable interest rate as your main account.

This can work well if you, for example, loan some money to a family member and want to keep the related financials separate from your main account. Or, perhaps you’ve purchased an investment and need to track the debt separately for tax purposes.

Interest attributed to the debt within your tracking sub-account is charged directly to your main account each month. You may set up your sub-account payments as:

-

Interest-only payments from your main account, or

-

Principal and interest payments from your main account. With this option, your sub-account balance will be reduced by the amount of the principal payment each month.

For more details on tracking sub-accounts, review our FAQ or check out the video on this page to see how well a tracking sub-account may work for you.

Term sub-accounts

If locking in some of your debt and ensuring your debt is repaid over time is important to you, a term sub-account may be a great option.

Term sub-accounts allow you to lock in a portion of your debt at either a variable or a fixed interest rate – a great option if you want to, for example, buy a car or renovate your home. With a term sub-account, you will also enjoy predictable monthly payments – much like a traditional mortgage.

You can have either an open or closed term sub-account. Both types are set up with a defined amortization period -- the amount of time it will take to pay off the sub-account, allowing you to maintain a disciplined payment schedule and reduce your debt over time.

Principal and interest payments for your term sub-account are based on the amortization schedule you choose and made from your main account on the last day of every month. Interest paid on the sub-account is tracked separately online and on your monthly statement.

… and you choose to set up a term sub-account, you can make payments that either:

-

Decrease the credit limit of your main account; or

-

Create additional borrowing room in your main account – the choice is yours.

… the amount of credit that’s available over 65 per cent must be allocated to a term sub-account.

Each monthly principal payment or lump-sum payment you make to your sub-account will effectively decrease the credit limit of your main account.

**If you’re a small business owner, or if your Manulife One account has been used to purchase an investment property, the amount of credit that’s available over 50 per cent of the value of your home must be allocated to a term sub-account. If your borrowing limit is below 50 per cent of the value of your home, you can choose to set up a term sub-account and make payments that either decrease the credit limit of your main account or create additional borrowing room in your main account.

For more details on term sub-accounts, review our FAQ or check out the video on this page to see how well a term sub-account may work for you.

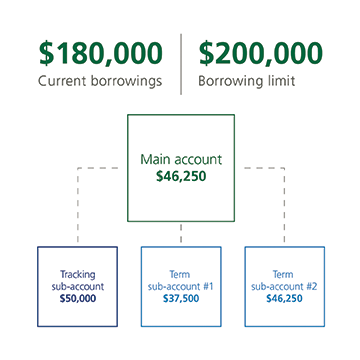

Here’s an example of effective use of both tracking and term sub-accounts.

The Cornells’ home has a value of $250,000. They opened a Manulife One account with a borrowing limit of $200,000 (80 per cent of the value of their home) and initial borrowings of $180,000.

A recent $50,000 investment purchase is part of their balance. The Cornells would like to be able to track the interest and the payments they make on this purchase so they set up a tracking sub-account with a balance of $50,000.

In addition, because they are requesting a borrowing limit of $200,000, they must allocate $37,500 (the amount above 65 per cent of the value of their home) to a term sub-account. Their overall borrowing limit will be reduced by the amount of the principal payments to this sub-account. They select a short amortization period for their term sub-account in order to pay down this portion of their debt quickly.

-

Tracking sub-account (Investment) – $50,000

-

Term sub-account – $37,500

The remaining balance in the main account is $92,500. Not long after this, they decided to take half of their remaining balance – $46,250 – and lock it into a two-year fixed rate sub-account to cushion against future interest rate increases.

For illustration purposes only.